I've blogged about this before -- over a year ago, in fact -- but some bad ideas just won't go away. Now the money boys want to put the Financial Accounting Standards Board (FASB), the folks charged with setting standards for honesty in accounting, under an oversight committee that will have leeway in calling for honesty in assessing the value of "distressed" holding during times of extraordinary financial conditions. There's to be normal honesty and another -- abnormal -- sort of honesty, when conditions mandate.

Last night at a gallery in Dallas, I spoke with a woman who, informed that the painting we were admiring was on sale for $95,000, asked why it cost so much. My answer was that was what the market would bear. It is worth what can reasonably be expected, given prior sales and the condition of the market so far as the artist and his dealer can assess it. Under those conditions, the painting was offered at that price.

Will it sell? Hell, I don't know. I own a six-year-old car. It is available for a price. If I set the price too high, it won't sell. Price it low enough, however, and I make a sale. Will that painting sell? It will if $95K is the right price.

The same is true for a CMO. Its value is what you can sell it for. A financial institution with illiquid assets on its books can not arbitrarily assess the value of its holdings apart from what they will sell for. What does it cost to buy it? Well, that's what it is worth. This is what is called mark-to-market accounting.

And yet it would appear there are arguments for another valuation system -- one based on the wishful thinking of bankers, not their much loved market. There is a move underfoot to move FASB into another realm, a realm devoted to loosening standards of valuation when "systemic risk" is abroad in the land and children are routinely devoured by wild things. The story is discussed here.

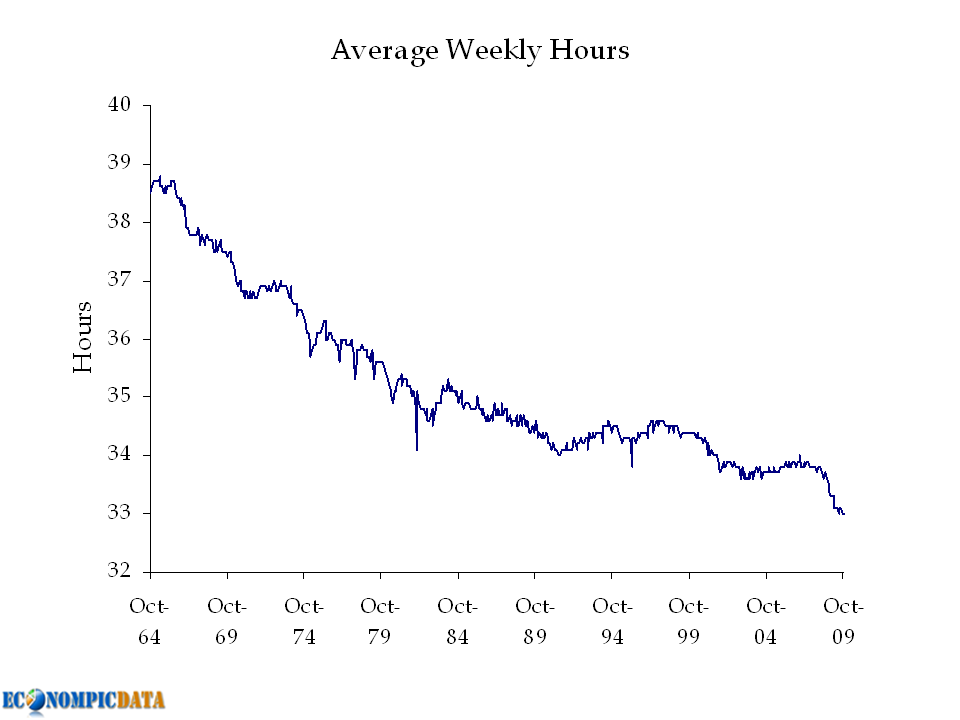

Meanwhile, check this:

(Image from Ritholtz)

(Image from Ritholtz)The people of our nation are not working. This is because of a financial crisis. The crisis was caused by inadequately comprehending the values of assorted financial instruments and consequent recklessness in trading them.

Two thirds of all the economic activity in America is consumer spending. Jobless folks are way less likely to spend than their employed counterparts. And even employed folks who fear unemployment are less likely to buy stuff.

Loosen accounting rules? Sure. That's a great idea.

1 comment:

Post a Comment